West Genesee State Audit: Capital Assets and Taxpayer Accountability

Posted on RespectTheNeighborhood.com

Why I think voters voted it down: I was browsing through some social media posts, and saw someone posting about an Audit in 2024 something I knew nothing about. It gives new meaning to the line...

"The District is presenting conceptual plans created in conjunction with the District's architect. Detailed plans are not finalized prior to the vote as the vote is to authorize the funding and general scope"

I see the CEO David C. Bills framed it as "jeesh it was only xx dollars, we need a roof whatever shall we do now" the XX dollars CEO David C. Bills talks about is:

- Before a SINGLE blade of grass is cut.

- Before ANY operational costs = budget real cost per year.

Hey CEO Dude ... I bet you could have fixed the roof with any number of millions you got the last time .. but it appears you chose "Brand Awareness".

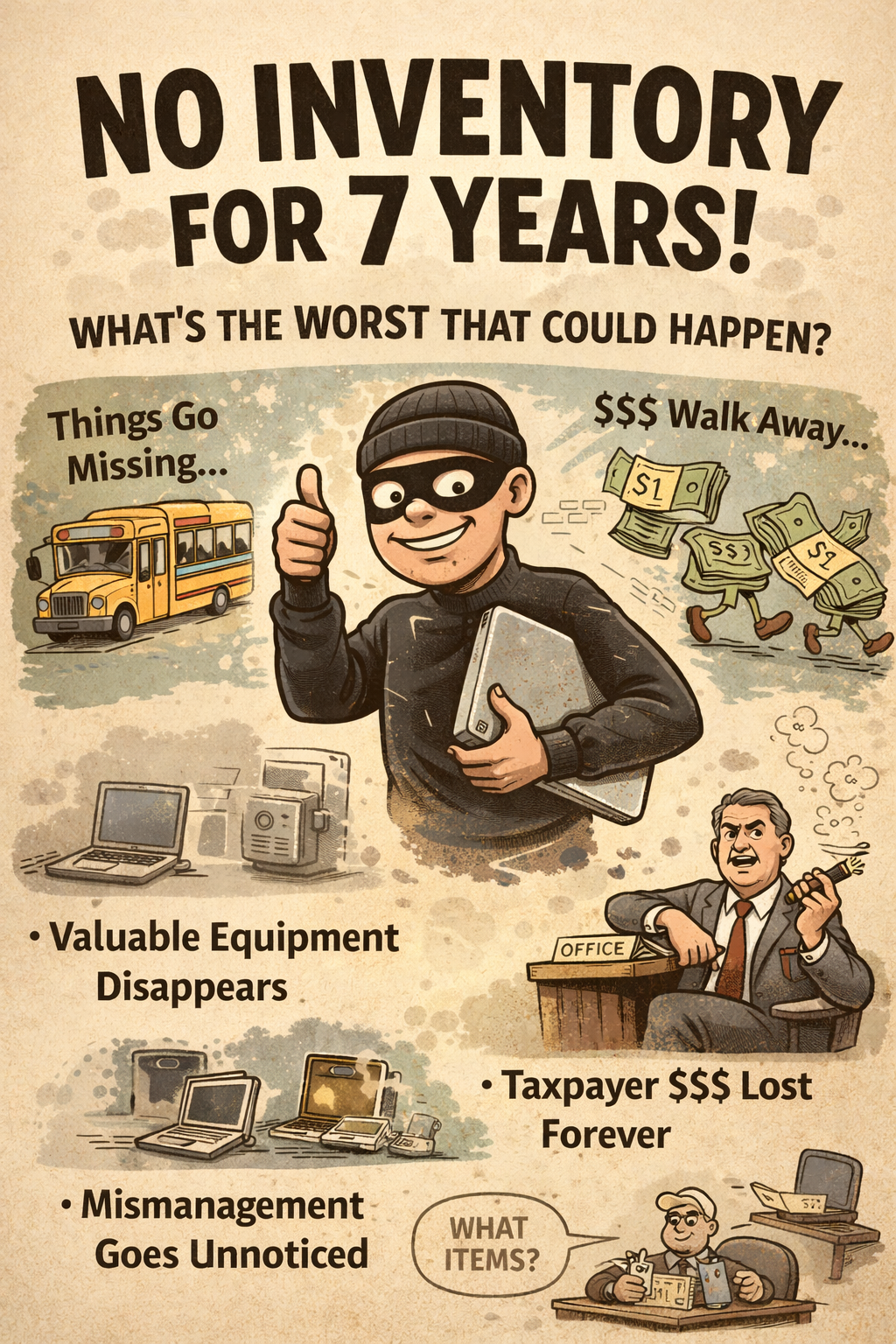

The district had not completed a full physical inventory since 2017. <-- That's 7 YEARS!!

I mean they had to get a lock on this before they asked for 78 Million more right ? To be clear this was found by a state audit AFTER they received their last 40+ million dollars.

Imagine if NO state audit was done ?

This led me to the boards meeting minutes site, which in all honesty where I should have started. I see according to meeting minutes that some steps may have been taken but its hard to find the resolution, link below.

https://go.boarddocs.com/ny/westgenesee/Board.nsf/Public

I did my searching on a PC, as I cannot imagine how difficult it would be to use this site on mobile and do any sort of comparison. Its probably what they count on.

One more time.....

The district had not completed a full physical inventory since 2017. <-- 7 YEARS!!

One comment on the below. The District "generally" agreed with the findings... from some of the one liners I read in their documents "generally" equals the phrase "but..."

Our money ... in the hands of a culture that allowed 1,2,3,4,5,6,7 (minimum) Years of this. That is not something that gets fixed in one year no matter what one line statement they put out.

"Ok we are good now" let us show you more pictures of the kids please...

West Genesee’s State Audit: What the Comptroller Found and Why It Matters

In February 2024, the New York State Comptroller’s Office released a Capital Assets audit of the West Genesee Central School District (Audit 2023M-128). The purpose was to determine whether district officials were properly monitoring and accounting for the equipment, technology, and physical assets purchased with taxpayer dollars.

What the auditors found should concern every homeowner, renter, and parent in the district.

Quick Snapshot of the Audit

According to the Comptroller’s report:

- The district manages a budget of about $97.2 million (2022–23).

- It has 5,347 recorded capital assets worth approximately $28.2 million.

- A sample of 337 assets valued at about $2.3 million was audited.

Source:

West Genesee CSD Capital Assets Audit (2023M-128):

https://www.osc.ny.gov/local-government/audits/school-district/2024/02/16/west-genesee-central-school-district-capital-assets-2023m-128

What the State Found using only a very small sample of assets

From the --> 337 assets extremely small sample <-- reviewed:

-

54 assets were in use but not in the inventory system.

- 38 of these assets, costing over $176,000, had no property tags.

-

27 assets could not be located at all. <------

- 18 had known costs totaling about $50,905.

- 9 had no cost information recorded.

-

45 assets had incorrect location information in district records.

For disposed items:

- Of 168 assets listed as “disposed,” 156 were disposed of before or without Board of Education approval.

The most striking systemic issue:

The district had not completed a full physical inventory since 2017.

This means for seven years, the district relied on updating lists instead of verifying that equipment actually existed.

Why This Matters for Taxpayers

When a school district does not maintain accurate asset records:

- The risk of loss, theft, and misuse increases dramatically.

- Staff may replace equipment simply because older items “cannot be found.”

- The Board of Education receives incomplete information when making financial decisions.

- Taxpayers ultimately pay more to replace items that may still exist but were never tracked.

This matters even more because West Genesee is in the middle of large, multi-million-dollar capital projects involving new buildings, equipment, grounds work, and technology—meaning more assets to track responsibly.

How This Connects to Current Capital Projects

Recent public filings describe major expenditures under the district’s capital improvement programs.

When combined with a basically non-existent asset tracking system, the scale of these projects raises valid questions:

If the district cannot track existing equipment, how confidently can it manage the influx of new equipment, technology, vehicles, and infrastructure?

What the Comptroller Told West Genesee to Fix

The audit recommended that West Genesee:

- Maintain complete and accurate capital asset records.

- Tag all applicable assets as district property.

- Conduct a full physical inventory of all assets.

- Correct inaccurate location and status information.

- Ensure all disposals follow Board-approved procedures.

- Maintain documentation for purchases, tagging, movement, and disposal.

- Strengthen internal controls to prevent recurrence.

District officials stated they generally agreed with the findings and would take corrective action.

How Residents Can Follow Up

Residents can begin asking the district:

- Has the required post-audit physical inventory been completed?

- Which assets have been confirmed missing, recovered, or written off?

- What new procedures have been implemented since February 2024?

- Has the Corrective Action Plan (CAP) been publicly posted or acknowledged by the Board?

You may also submit a FOIL request for:

- The Corrective Action Plan

- Any inventory or reconciliation completed after the audit

- Updated asset tracking policies

- Documentation regarding missing or untagged assets

- Board minutes or resolutions related to audit follow-up

What Comes Next

The State Comptroller’s Office has made it clear:

- West Genesee’s asset tracking and internal controls had serious weaknesses.

- Taxpayers deserve transparency about what has changed since the audit.

- The district must not only file a Corrective Action Plan, but also implement and demonstrate those corrective actions.

Residents have every right to continue asking:

- Has the district fixed these issues?

- How is oversight being ensured now?

- Are new assets from current capital projects being tracked correctly?

Accountability is not personal—it is fundamental to responsible stewardship of public funds.

And the big one:

Why did it take a state audit to uncover all of this?

What Comes Next — and Why This Isn’t Going Away

The audit is public.

The findings are public.

The numbers are public.

References

-

New York State Comptroller – West Genesee Central School District: Capital Assets (Audit 2023M-128)

https://www.osc.ny.gov/local-government/audits/school-district/2024/02/16/west-genesee-central-school-district-capital-assets-2023m-128 -

Full PDF of the audit report

https://www.osc.ny.gov/files/local-government/audits/2024/pdf/west-genesee-central-school-district-2023-128.pdf -

West Genesee Board of Education – Public Documents, Agendas, Capital Project Information

https://www.westgenesee.org/district/board-of-education/

Regardless what they say "fixed", 7 YEARS!!!!!! , scars are a thing... trust is a thing .. how do you trust an organization like this with your money ?