West Genesee Tax Levy History: 10 Years of Increases and What Comes Next

Posted on RespectTheNeighborhood.com

The pragmatic side of me says no way the school would fabricate the parking crisis to make sure this vote passes right ? yeah probably crazy talk. You know the vote you to give them the money that they will then decide what to do with ?

Dec 9th

I verified most of the data below but if there is anything that you don't trust please verify

If your home valuation goes up, your school taxes go up — no matter what charts the district shows.

David C. Bills and the West Genesee Board may present “average impact” numbers, but your actual tax bill is based on your home’s assessment. And assessments in this area almost always rise. I guess this is cool if you don't plan on retiring here or you never fall on hard times. I am sure David C. Bills will be there for you.

So even if they say the rate is flat or down, that doesn’t matter. Your tax bill rises. Every. Single. Time.

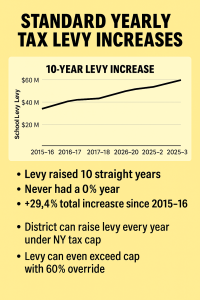

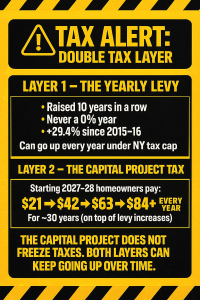

“10 straight years of levy increases — about 29.4% more collected from taxpayers than a decade ago.”

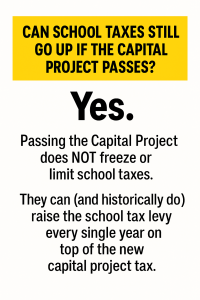

Passing the Capital Project does NOT freeze or limit school taxes.

They can (and historically do) raise the school tax levy every single year on top of the new capital project tax.

So maybe Camillus is far more Affluent than I know,

| School Year | Tax Levy | YoY Change |

|---|---|---|

| 2015–16 | $45,955,000 | baseline |

| 2016–17 | $46,769,000 | +1.77% |

| 2017–18 | $47,672,000 | +1.93% |

| 2018–19 | $48,866,000 | +2.50% |

| 2019–20 | $50,042,000 | +2.41% |

| 2020–21 | $51,502,030 | +2.92% |

| 2021–22 | $52,496,485 | +1.93% |

| 2022–23 | $53,809,708 | +2.50% |

| 2023–24 | $55,262,877 | +2.70% |

| 2024–25 | $57,219,143 | +3.54% |

| 2025–26 (proposed) | $59,447,096 | +3.89% |

David C Bills in his cushy Tax Payer funded job has little worries because he will just keep giving himself raises in May ...

Peace, -RTN